Unlock Your Staked SOL with SolBlaze: A Guide to Liquid Staking

Discover Liquid Staking, Rewards, and DeFi Growth with SolBlaze and its ecosystem.

The Solana DeFi landscape has experienced a dramatic transformation over the years, fueled by the rapid adoption of Liquid Staking. This innovative approach has seen extraordinary growth in the most recent two quarters, from $205.5m in September 2023 to a staggering $2.05b in February 2024 - a whopping 950% increase approximately. The key to its popularity lies in its solution to a fundamental limitation of traditional native staking. By providing users with both the rewards of staking and the flexibility to use their staked assets, it offers a more adaptable and risk-mitigating approach in the dynamic world of cryptocurrency. Within the Solana ecosystem, protocols like Jito, Marinade, and BlazeStake have emerged as the leading contributors in the liquid staking domain, ranked by their Total Value Locked (TVL). While all three protocols have significantly impacted the ecosystem, this article will focus on SolBlaze, the creators of BlazeStake, and their more comprehensive contributions to the Solana landscape. To grasp their significance, we need to start by reviewing the principles of native and liquid staking. This foundation will illuminate how the suite of products by Solblaze, including BlazeStake, contributes to the Solana Ecosystem.

1. Native Staking: The Prologue

Blockchains fundamentally address the challenge of trust. Native staking is a central mechanism in Proof-of-Stake (PoS) networks, in our case - Solana, promoting security and validating transactions. It offers passive income opportunities for holders of the native asset of a given blockchain, who fully control their staked assets.

The formal definition of Native staking is:

Native Staking or simply staking is a process through which holders of the native asset delegate their tokens to validators responsible for processing transactions and securing the network. By delegating, stakers essentially lend their tokens to increase a validator's voting power, contributing to the blockchain's integrity. In exchange for their support, stakers receive a share of the rewards generated by the validators, offering a way to earn passive income on their holdings.

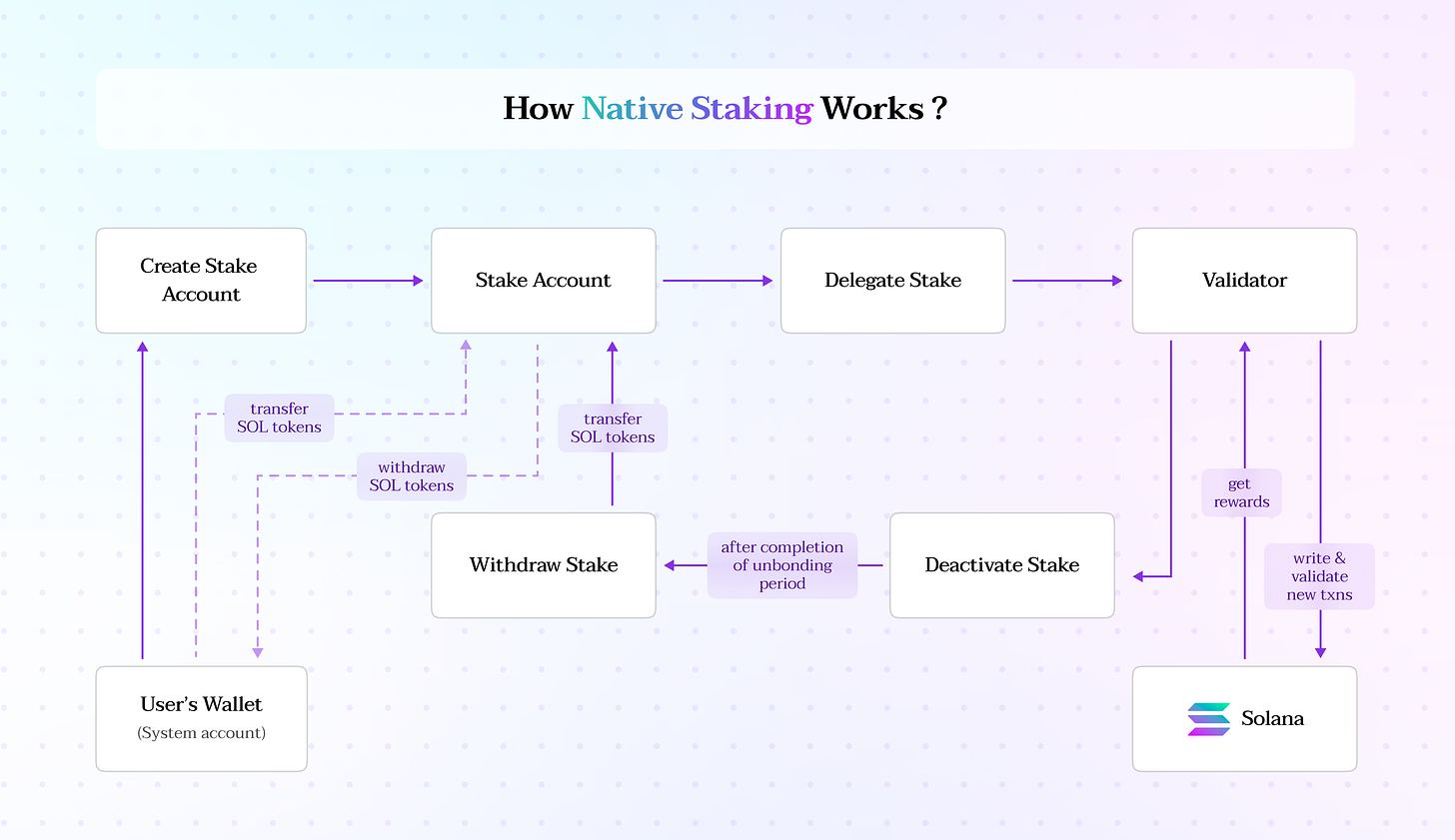

Let’s use a visual illustration to explain the native staking concept and how it works.

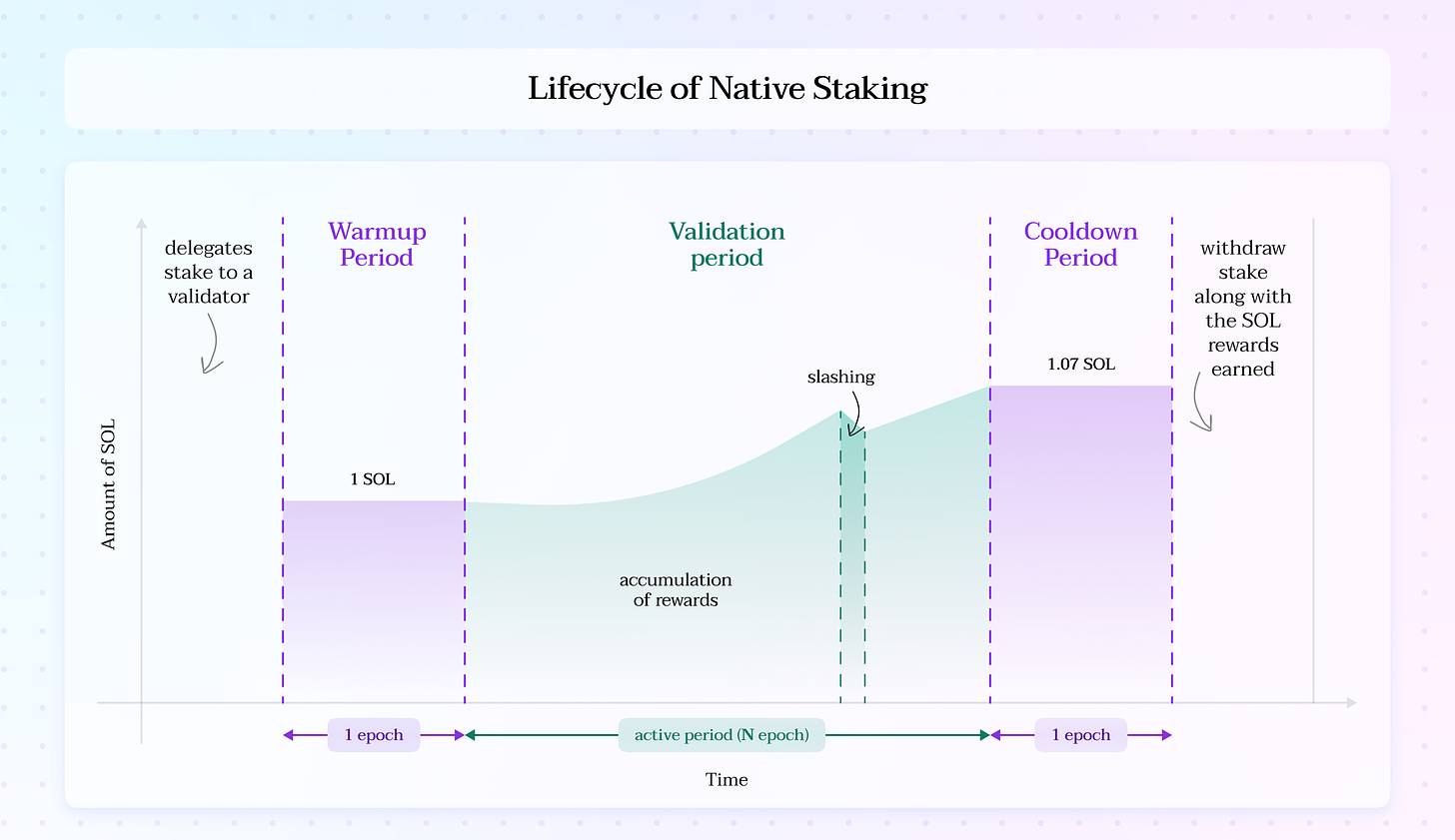

The above illustration depicts a system where stake accounts are created from a system account but operate independently. Staking and withdrawing requires assigning authority to a designated system account. A single stake account can delegate SOL tokens to only one validator at a time. To delegate SOL tokens to multiple validators, users are required to create separate stake accounts and manage each delegation individually. Also, Delegated tokens do not immediately begin earning rewards. A short warmup period (bonding period) occurs first.

Following the warmup period, the system fully stakes the tokens. The delegator then earns rewards whenever their chosen validator participates in processing blockchain transactions. Each correct transaction and participation in the consensus leads to rewards for them and their delegators. The Solana network design incentivizes delegators to choose successful validators. As a validator attracts more delegators and increases its stake, rewards grow for both the validator and its delegators. This positive feedback loop benefits the entire network.

Three main characteristics of a successful validator:

Technical Reliability: Maintains robust infrastructure and security practices.

Network Commitment: Participates in governance and supports the core principles of the blockchain.

Delegator Focus: Offers competitive rewards and builds community trust.

Once a delegator decides to unstake their SOL tokens, they cannot immediately access them. A cooldown period (unbonding period) temporarily locks the tokens. After approximately two days (the exact time depends on the network), the unstaked SOL tokens become available for withdrawal. The essential point is that once the unstaking process begins, the tokens will stop earning rewards during that cooldown period.

And so the cycle continues. Remember, warmup and cooldown periods are essential for ensuring the security and decentralized operation of the chain. These periods act as checkpoints, temporarily restricting access to staked tokens. Once a checkpoint is reached, validators verify the integrity of all transactions since the previous checkpoint. This generates a tamper-proof history of transactions, making future validation more efficient. The duration between the consecutive checkpoints is called an epoch. For real-time updates on the current epoch progress, visit Solana Beach.

Native staking can be challenging for delegators. They must place significant trust in their chosen validator, as malicious or incompetent validator behavior can lead to slashed stakes. Besides, the lengthy warmup and cooldown periods (approximately two days on Solana) create delays and friction in the rapidly evolving crypto market. Fortunately, new approaches offer the security and rewards of native staking while improving several vital aspects of the user experience.

With a grasp of native staking and its limitations, let’s delve into liquid staking and how it offers significant benefits.

2. Fundamentals of Liquid Staking

Now that we understand native staking, grasping liquid staking becomes more straightforward. In essence, liquid staking enables delegators to receive a proxy token upon staking their native tokens. This proxy token represents the value of the staked native tokens plus any accumulated rewards. It can then be used for various purposes within the DeFi ecosystem.

The formal definition of Liquid Staking is:

Liquid staking is a staking mechanism within Proof-of-Stake (PoS) blockchain protocols that facilitates the issuance of liquid derivative tokens upon the delegation of native assets. These derivative tokens represent a claim on the underlying staked assets and their associated rewards, enabling greater capital efficiency and flexibility within the DeFi ecosystem.

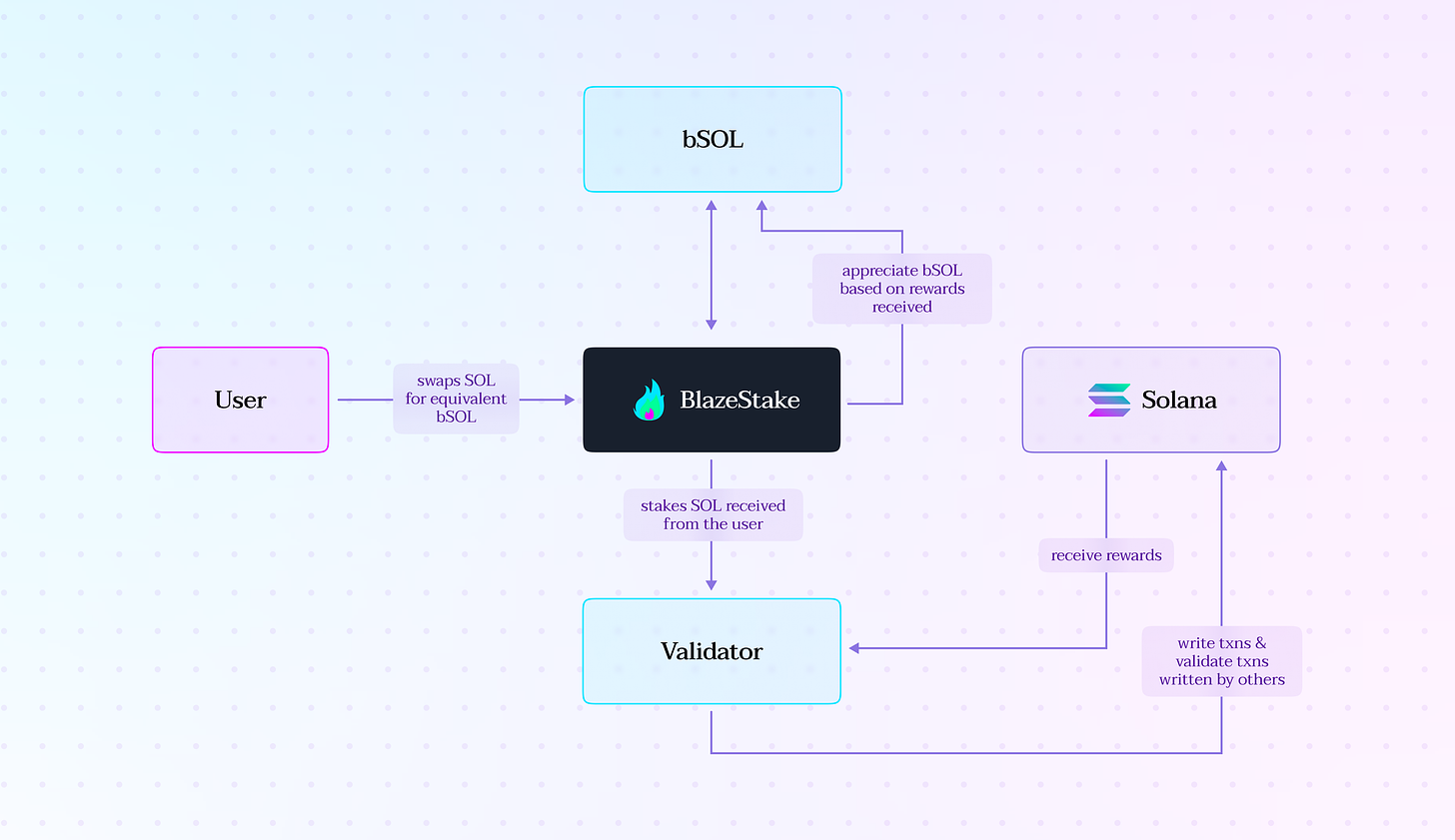

Let’s understand this with an example to pave a better picture using SolBlaze.

Choose Liquid Staking: Instead of directly staking on the Solana network (which locks your SOL during warmup/cooldown), opt for a liquid staking protocol like SolBlaze.

Connect and Stake: Visit stake.solblaze.org and connect your preferred wallet. Stake the desired amount of SOL and begin earning rewards immediately.

Receive bSOL: Instantly receive bSOL tokens, representing your staked SOL and potential rewards. Over time, bSOL prices surge as rewards accrue.

Unlock a World of DeFi: Unlike native staking, bSOL empowers you with new financial possibilities:

Borrow assets on lending platforms like Solend by using bSOL as collateral.

Earn additional yields by providing liquidity on token aggregators for further passive income.

Trade or transfer your bSOL while continuing to earn staking rewards, maximizing capital efficiency.

Essential Benefits of Liquid Staking:

Bypass Cooldown Periods: Access and use your staked value without waiting.

No Validator Selection: Smart contracts optimize delegation for you.

Maintains Decentralization: Supports a secure and diversified Solana network.

Increased Flexibility: Utilize bSOL in DeFi without unstaking your SOL.

However, the flexibility and liquidity offered by liquid staking come with trade-offs to be aware of. These include:

Smart Contract Risk: Liquid staking protocols rely on smart contracts, which, like any code, can have vulnerabilities. Any exploit in these contracts could result in the loss of staked assets or rewards.

Platform Risk: Liquid staking relies on the stability and trustworthiness of the chosen platform. Centralization issues, poor management, or security breaches within a specific protocol pose risks to user funds.

Potential De-pegging: In some cases, the derivative token representing staked assets (e.g., bSOL) could de-peg from the underlying asset (e.g., SOL). This could occur due to market fluctuations, protocol issues, or loss of confidence.

Rewards Dilution: Some liquid staking platforms offer less staking rewards than native staking. This is often a trade-off for the increased liquidity and flexibility they provide.

The severity of these risks varies depending on the specific liquid staking protocol. So, it is critical to use reputable platforms with robust security measures and a track record of transparency.

Now, we have a basic understanding of the capabilities and trade-offs of liquid staking. Let’s start to understand SolBlaze.

3. SolBlaze: The Introduction

SolBlaze is an emerging DAO (Decentralized Autonomous Organization) that focuses on improving the Solana Ecosystem. The rapid development of their groundbreaking products has propelled the ecosystem in a remarkably short time.

The following are the product contributions:

BlazeStake: a Liquid Staking Pool

BlazeRewards: Global Rewards Program liquid staking and DeFi adoption on Solana

SOL Faucet: Mainnet Solana Faucet

Status: Uptime of several RPC providers

Token Minter: Simple Token Minter: Create your own SPL token on Solana

SOL Pay SDK: Non-Custodial Solana Payments Frontend JavaScript SDK

SolBlaze has introduced the $BLZE governance token, designed to enhance BlazeRewards through airdrops for active BlazeStake users and to support the long-term growth of the ecosystem. Blazenomics will be covered soon. First, we will focus on the innovative solutions provided by SolBlaze.

4. BlazeStake: The Powerhouse of SolBlaze

BlazeStake is a liquid staking pool that caters to users who want to stake Solana effortlessly by providing proxy tokens - bSOL and incentivizes staking in return for rewards. The received proxy tokens offer flexibility, allowing holders to provide liquidity, use it on lending and borrowing platforms, or swap it for other tokens.

BlazeStake promotes decentralization and high rewards with about 240+ carefully selected validators. This ensures a wide range of smaller, high-performing options are available without compromising staking returns.

The principal reason behind the existence of BlazeStake is superminority (a.k.a security group). Superminority means the minimum number of validators having more than 33% total staked SOL. Presently, the superminority is 21, which means these 21 validators having more than 33% of total staked SOL will be a threat to halt (prevention of writing new blocks to Solana). So, a higher superminority leads to more decentralization and increases the security of the blockchain.

Although it is a huge step, the ideology of BlazeStake helps to increase superminority by giving support validators to maintain high performance and high scores without sacrificing stake rewards.

With the understanding of superminority, it should be much easier to understand their delegation strategy across various validators.

4.1. BlazeStake Delegation Strategy

Validators outside the current superminority (those not in the top validators ranked by staked SOL) can participate in the SolBlaze Validator Pool. BlazeStake automates the staking process and allocates stake amounts to the respective validators based on an optimized algorithm guaranteeing the rate of overall rewards earned by these validators.

The staking algorithm is pretty much straightforward. It discourages validators in superminority. So, the Top 21 (superminority) are not qualified for the validator program, which means anyone above the halt line (validators in superminortiy) cannot participate in BlazeStake’s delegation strategy.

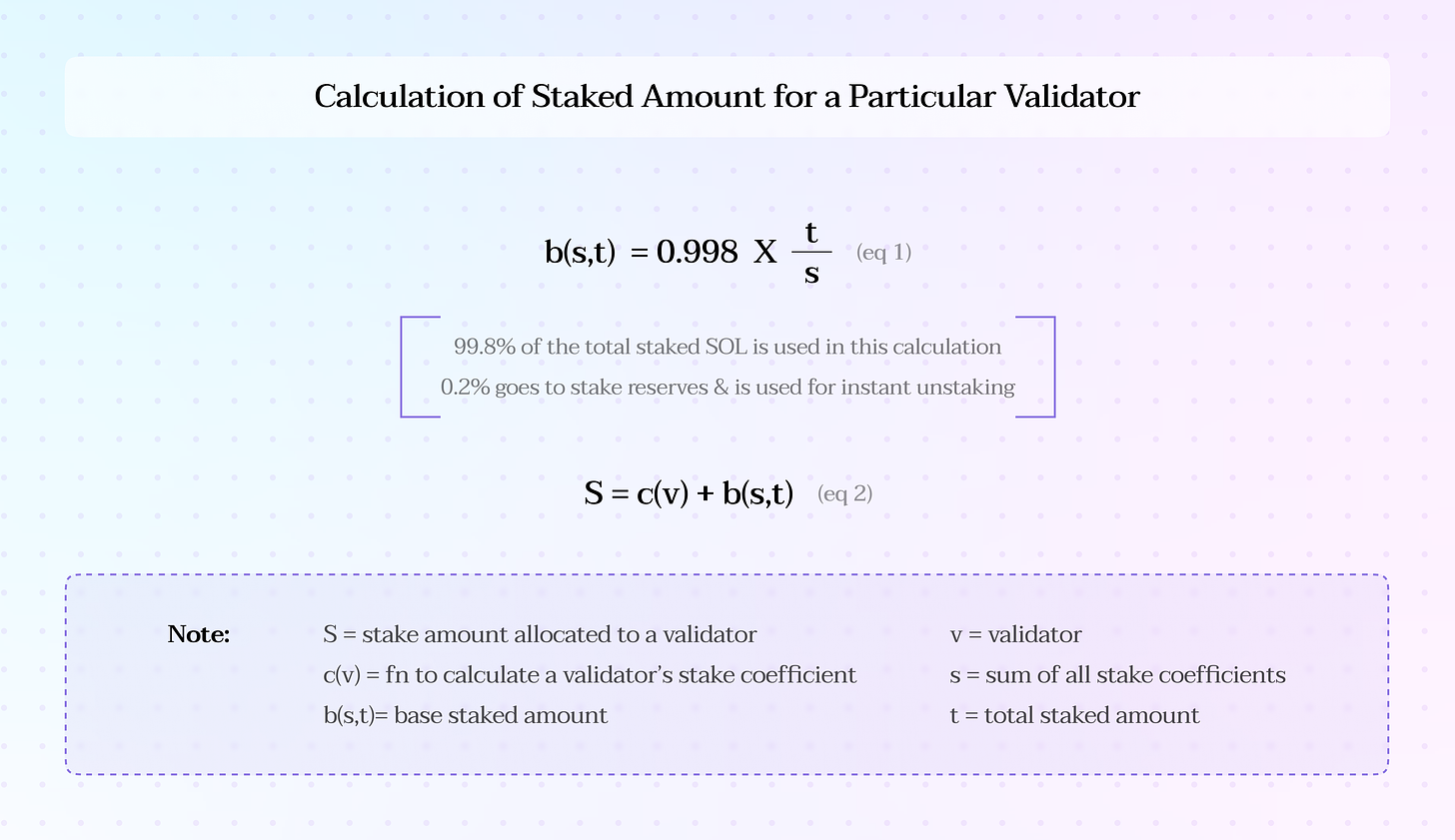

How is the staked amount for a particular validator calculated?

From the below illustration, the staked amount for a particular validator (S) can be calculated by multiplying the stake coefficient by the base stake amount.

The stake coefficient takes care of and prioritizes high-performing and high-scoring validators as they are leading contributors to the rewards, and are with high-scoring are meant to be more credible.

The base stake amount is a ratio of 99.8% of the total stake amount (0.2% is set aside for instant unstaking) and the sum of all stake coefficients.

The Base Stake Amount is dynamic, determined by the total amount staked and individual stake coefficients. When the total staked amount is higher while stake coefficients are lower, validators are allocated more stakes on average. Conversely, lower total stake amounts while higher stake coefficients result in smaller base stake allocations.

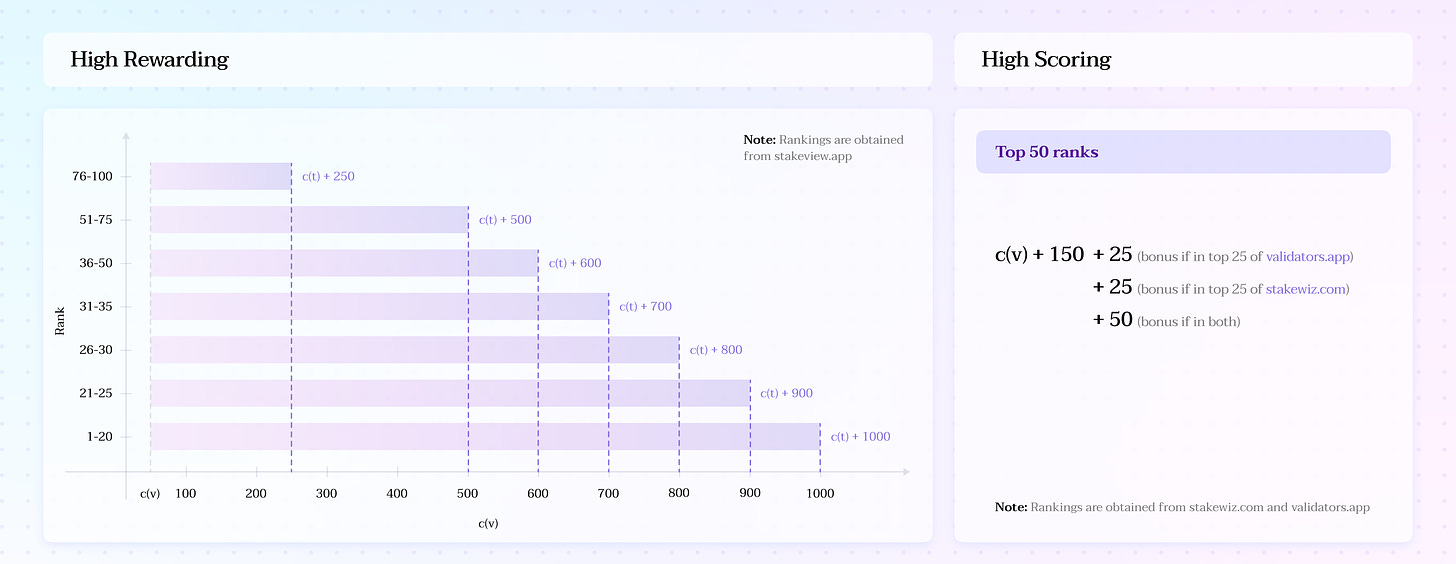

Stake Coefficient for high rewarding, high scoring, and small Validators

The below visual justifies the distribution of stake coefficients based on the validator score and the quality of rewards they generate along the way. Validator rankings based on rewards are obtained from the stakeview. Rankings based on validator scores are obtained from validators and stakewiz.

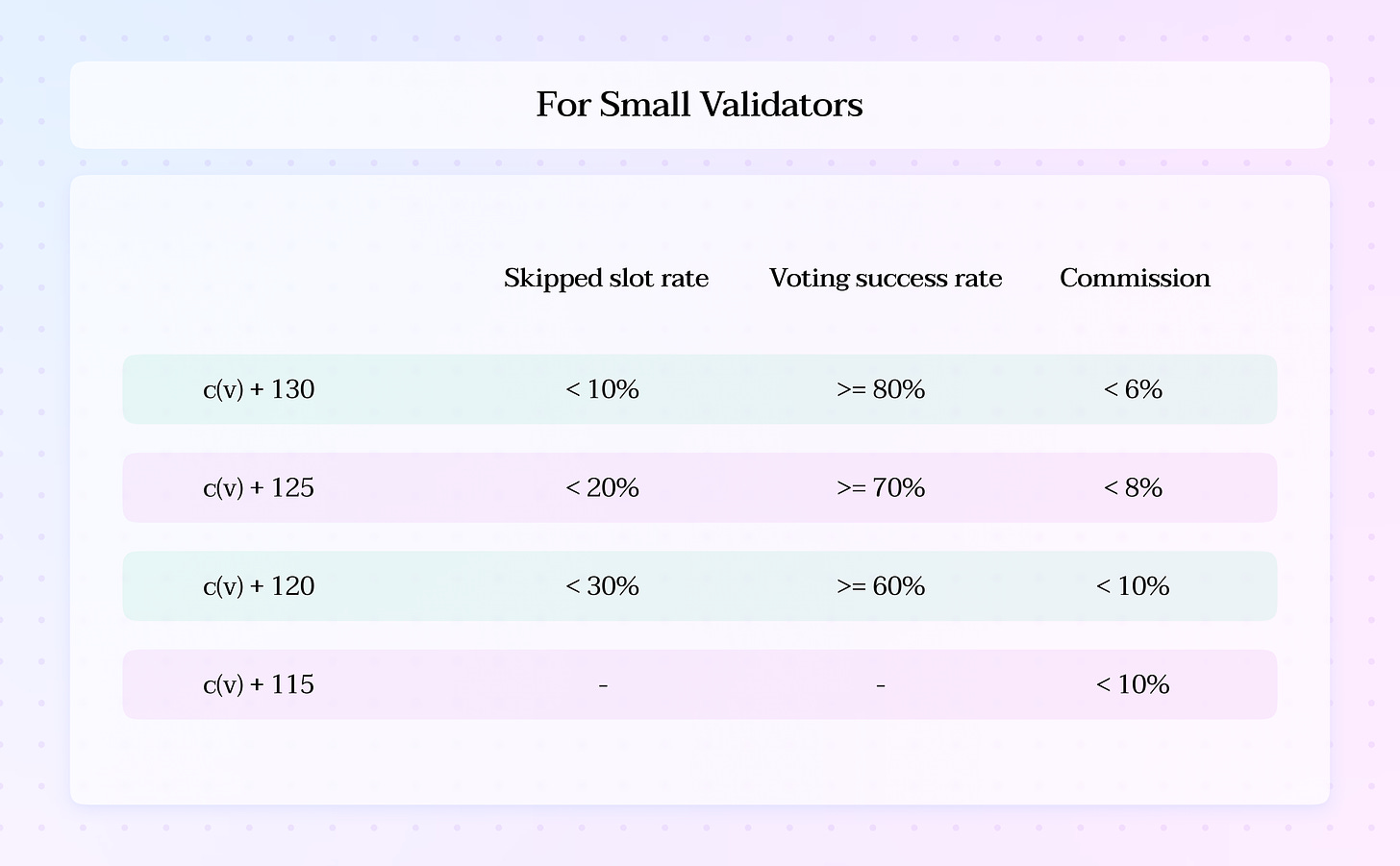

Small validators, having low validator rankings, are still considered vital candidates for validation strategy to maintain decentralization and security. But for them, stake coefficient incentives are in conditionals. The conditionals are covered in the figure below.

Overall, this delegation strategy emphasizes the importance of validator quality. This approach recognizes the potential impact of validator reliability and participation on network health and governance. For the long term, as the stake pool TVL grows, more BLZE tokens will get disbursed gradually to users, validators, and defi protocols, creating a community of token holders. This community will have voting power to govern upcoming decisions for the betterment of BlazeStake DAO, which we will further discuss in the BlazeRewards section.

4.2. Custom Liquid Staking

What if the user wants to stake for a particular validator but still wants bSOL for the same? BlazeStake offers a similar unique feature called Custom Liquid Staking (CLS). This lets user directly stake their SOL to a specific validator of their choice, bypassing the standard BlazeStake delegation strategy. With CLS, user can support their preferred validators while gaining the liquidity and DeFi benefits of bSOL tokens.

The CLS protocol ensures user stakes remain valid by constantly checking the bSOL balance in your wallet. To maintain custom staking, one must hold a minimum threshold of bSOL. However, the users could all lend or provide liquidity bSOL to these supported DeFi protocols. This system offers flexibility and a bonus on top of staked rewards. BlazeStake can even help create custom delegation strategies (similar to Lamport DAO) for precise control over how the stakes are distributed across different validators in a specific group or a DAO.

4.3. Pool And Epoch Fees

Fees are a substantial component for any DeFi Protocol as it is one of the primary sources of income for the protocol. Fees, in general, help in maintenance as well. Solblaze also takes a small percentage of fees to support pool operations, the BlazeStake Treasury, SolBlaze developers, and extra rewards for users.

Here are the pool fees:

Deposit fee: 0%

Instant withdrawal fee: 0.1%

Delayed withdrawal fee: 0.1%

Epoch fee: 5%

The epoch fee is 5% of the staking rewards accumulated by the validators in each epoch. This epoch fee gets dispersed into various categories to maintain BlazeStake governance and other essential operations. The split of the epoch fee and withdrawal fee for each category is

Operations & Development: 50%

BLZE Burns: 20%

BLZE Liquidity: 20%

DAO Treasury: 10%

4.4. Instant Unstake And Delayed Unstake

There are two types of unstake methods available at the BlazeStake app:

Instant Unstake: If the users want to instant unstake (convert) their SOL for a given amount of bSOL in their wallet, they can go to unstake (instant) in the app, and swap bSOL for an equivalent of SOL at that instant. However, it is discouraged to instant unstake if the user wants to unstake a large amount of SOL. Also, at the time of unstake, SolBlaze takes a small percentage i.e., 0.1% of the unstaked amount as a withdrawal fee.

Delayed Unstake: If the users want to delay unstake (convert) their SOL for a given amount of bSOL in their wallet, they can go to unstake (delayed) in the app, and swap bSOL for an equivalent of SOL at that instant. In delayed unstake, instead of receiving SOL instantly, the user gets withdraw authority for a stake account (as discussed in native staking) for an equivalent SOL at that instant which the user can withdraw after the cooldown period. To unstake, follow these steps. SolBlaze also takes a small percentage i.e., 0.1% of the unstaked amount as a withdrawal fee.

4.5. Airdrops

Through BlazeRewards, a certain amount of BLZE is dispersed periodically in the form of airdrops to all the users, validators, and DeFi protocols who are actively staking SOL, providing liquidity for bSOL or lending bSOL for others to borrow.

4.6. Procedure to join the Validator Pool

The procedure to join the validator pool is very straightforward. If a validator is not a superminority, then it prequalifies them instantly. And, if a validator fulfills the criteria in the delegation strategy, then they can contact SolBlaze through the following:

contact solblaze_org on X.

Email to contact@solblaze.org with the subject: “Request to Join BlazeStake Pool!”.

Now, with a foundation regarding the principles of BlazeStake, it is time to delve into Blaze Rewards and Blazenomics, the tokenomics behind $BLZE.

5. BlazeRewards And Blazenomics

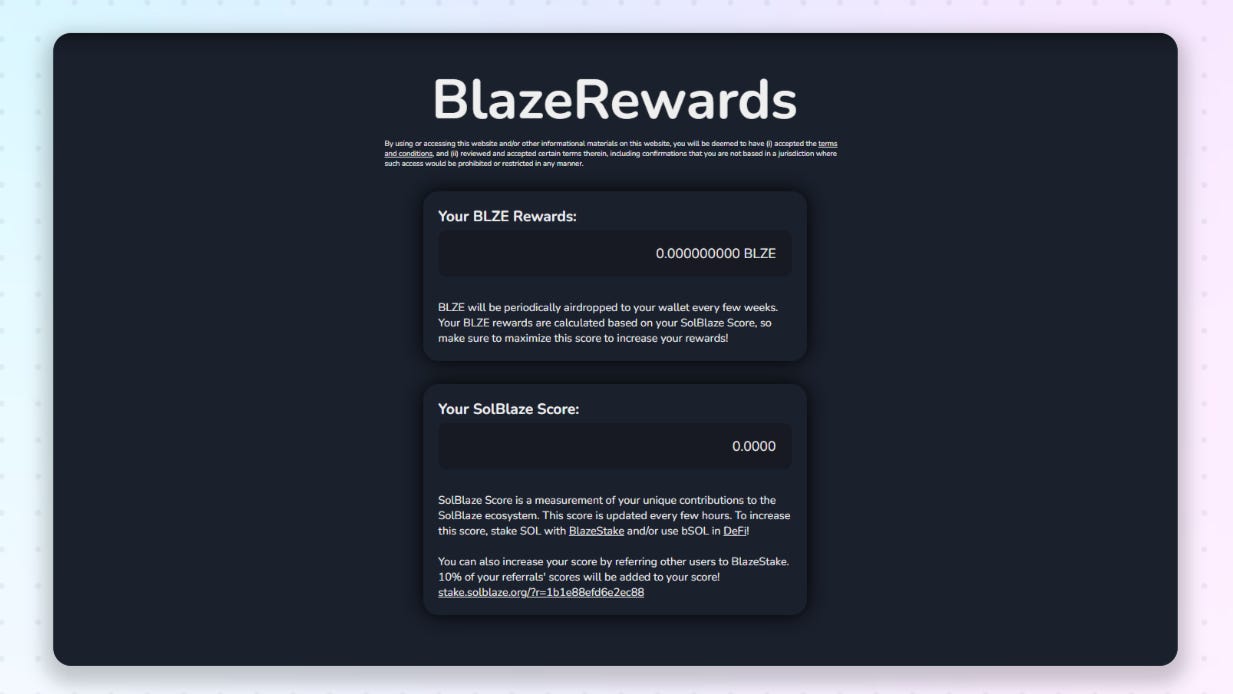

$BLZE, the governance token of SolBlaze, plays a central role in establishing BlazeStake as a premier liquid staking solution on the Solana network. Its unique rewards program incentivizes users to hold bSOL by regularly distributing $BLZE rewards directly to their wallets.

BlazeRewards helps in making this effort possible. It provides a great UI experience for users to track their rewards. Using Gauges helps gain up to 10x voting power by locking $BLZE tokens for up to 5 years. This incentivizes users to hold their tokens for forthcoming benefits.

Users get airdropped a certain amount of $BLZE for participating in BlazeStake based on their Blaze Score.

Blaze Score is a metric system to calculate rewards that users can avail on Blaze Rewards. The calculation process is relatively simple and rewards people having bSOL in their wallets, lending platforms, or liquidity pools. The scoring system looks like this:

holding bSOL in Wallets: +1

staking bSOL in Lending Platforms (e.g., Solend): +1.5

providing bSOL in Liquidity Pool Positions (e.g., Jupiter): +2

Blaze Score is also calculated for validators and DeFi protocols because they are instrumental in supplying liquidity to users. Custom liquid-staked validators & DeFi protocols also receive rewards based on this score. The scoring system for them is:

1 bSOL in DeFi Protocols: +1

1 SOL of custom liquid stake to a chosen validator: +1

Following are the ways one can earn rewards on BlazeRewards:

Go to BlazeStake, connect the wallet, and stake the SOL. Once staked, the users receive bSOL. The higher the amount of bSOL in the wallet, the higher the rewards.

The other option is to obtain bSOL from token aggregator protocols or swap assets directly in wallets such as Backpack, Solflare, and Phantom and get rewards as your wallet owns bSOL.

To earn more rewards (i.e., BLZE), stake bSOL on various lending platforms, liquidity pools, or token aggregator platforms as it increases your Blaze Score (as discussed above).

To summarize, the primary reason to choose bSOL over directly staking SOL is the ability to access your staked asset’s value without sacrificing staking rewards, which means you can use bSOL to borrow, provide liquidity, or engage in other DeFi activities, open up new opportunities. Additionally, bSOL often incorporates incentive mechanisms like increased rewards or governance rights, further enhancing its appeal.

6. SOL Pay SDK

SOL Pay SDK is a decentralized payment stream and payment SDK that caters to the needs of decentralized applications.

Using this SDK,

The users can interact with the dApps and transfer assets directly to the seller, i.e., deliver the payment to whomever it’s meant to be without any intermediaries.

The users can do micropayments every second, producing a steady stream, and the receiver can withdraw only after it reaches a certain threshold.

These two features are adaptable to various projects related to gaming, DeFi, and community development.

To integrate them to your front end, add the script tag in the HTML given in the quickstart in the Solpay Docs. If you want to incorporate it into your React applications, follow this article to add it to your component where you need to use Solpay.

Solpay is also going to integrate Stake Pools into their SDK. This integration will also smooth the process of adding stake pools into dApps with features like non-custodial transfers and streams.

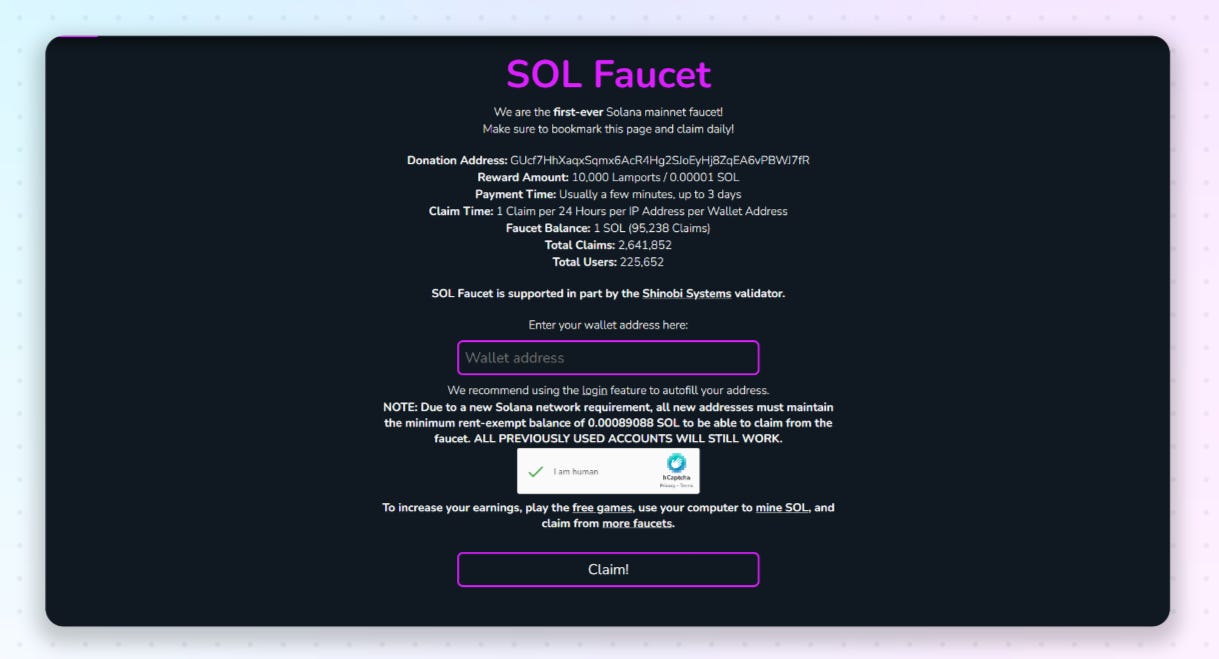

7. SOL Faucet: A Mainnet Faucet

Solana faucets are crucial for the Solana community as they provide small portions of SOL tokens on test networks. This enables developers to experiment without financial risk, accelerating innovation and lowering the barrier to entry. This accessibility and ease of experimentation ultimately drive the growth and adoption of the Solana network, leading to a stronger, more vibrant community.

SOL Faucet powered by SolBlaze offers a unique approach to contribution to the ecosystem. It provides a pinch of mainnet SOL for onboarding new users to interact with the platforms. Before using this faucet, users need a wallet with a minimum balance of 90,000 Lamports (approximately 0.0009 SOL). They can receive up to 10,000 Lamports (0.00001 SOL) per day. The requested SOL is delivered anytime between a few minutes to 3 days.

To learn about other ways to acquire mainnet SOL, visit SOL Faucet.

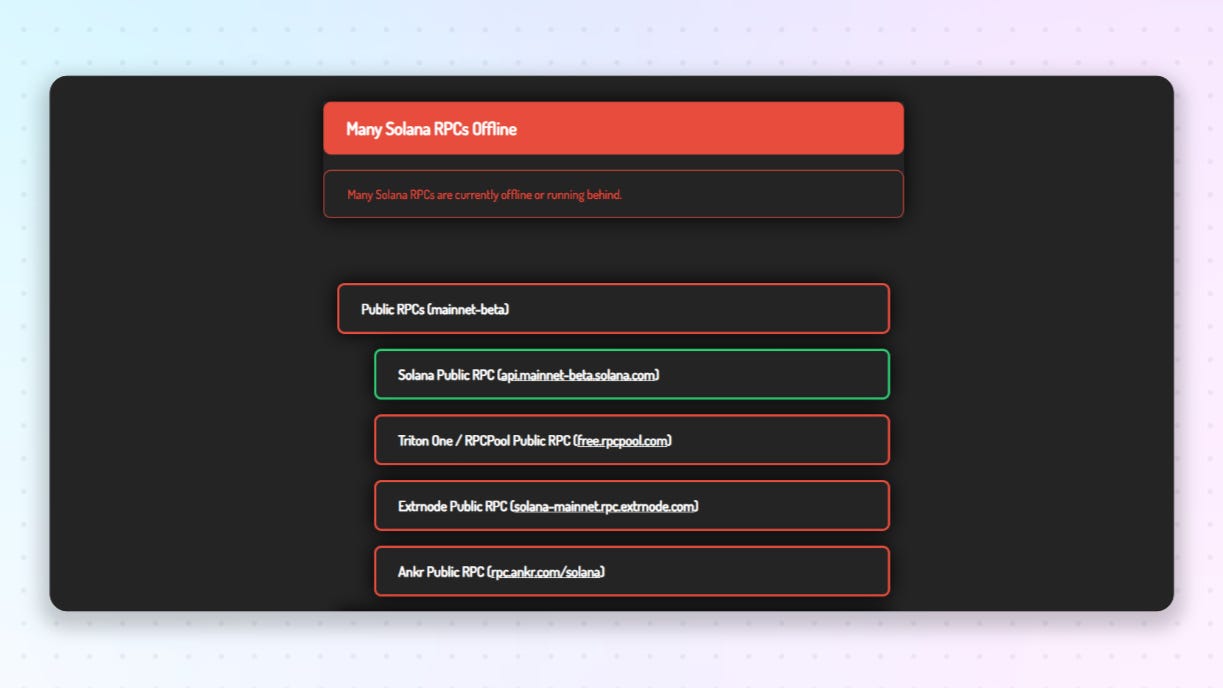

8. Status

Status by SolBlaze provides an inventory of public and private RPC URLs and their status to users. These RPC URLs can be used to fetch on-chain information from Solana. But to check if those RPC URLs are operating perfectly, the users can check the status of those RPC URLs at status.solblaze.org.

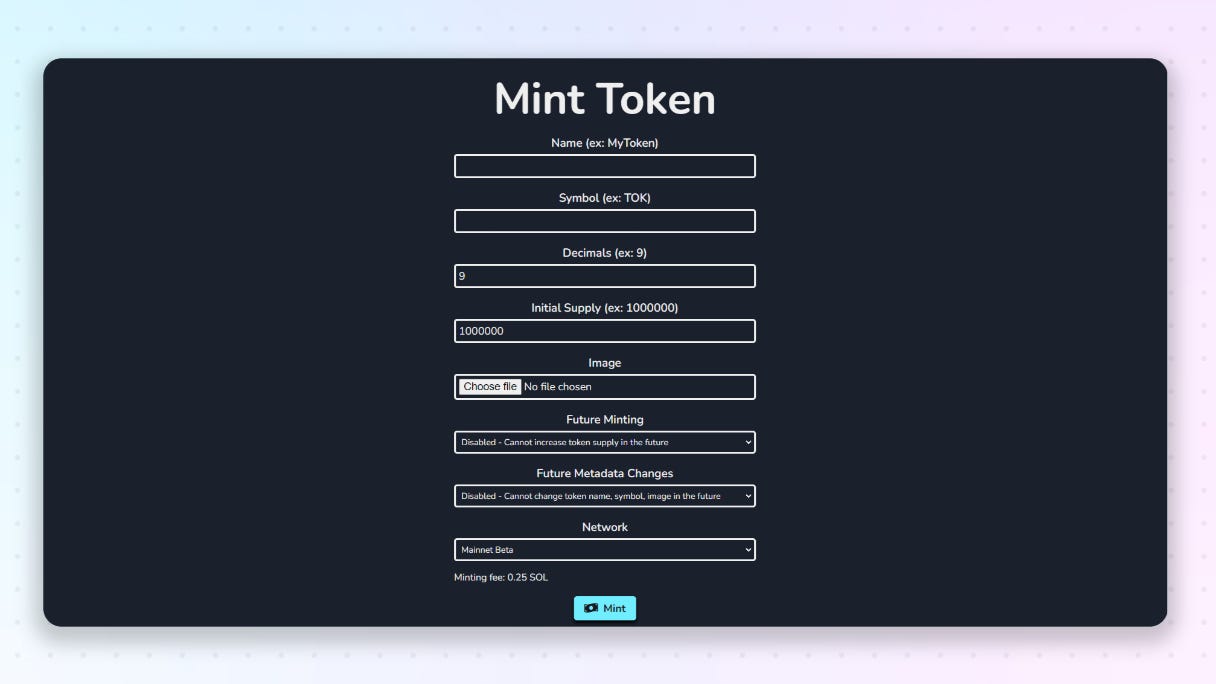

9. Token Minter

Token Minter is a user-cum-developer-friendly tool for quickly minting SPL Standard Tokens. Its intuitive UI simplifies the minting process, saving you time and effort.

Following are the steps to mint an SPL Token from Token Minter:

Visit Token Minter and fill out your token details: name, symbol, decimals, how many you want to create, and an image (optional). Double-check you are on the right network (Devnet for testing!).

Click Mint. And Voila! You have instantly created your own SPL token.

The purpose is to provide an effortless demo to mint an SPL token directly.

10. Conclusion: The Epilogue

The Solana DeFi ecosystem is flourishing and fueled by innovative protocols enhancing the user experience. The SolBlaze ecosystem plays a significant role in this growth, offering a range of products that expand the DeFi landscape on Solana. As the liquid staking category gains traction (evidenced by DefiLlama), the Solana DeFi ecosystem and total value locked (TVL) demonstrate impressive growth potential. This article aimed to introduce the readers to the transformative power of liquid staking and the possibilities it unlocks within DeFi. While the beauty of DeFi lies in its trustless nature, it’s important to mention that this article serves as a starting point, as investment must always be done with a well-informed and cautious approach. As liquid staking solutions like SolBlaze keep evolving, we can expect even greater liquidity, innovation, and user empowerment within this dynamic ecosystem.

Stay informed, stay curious, and embrace the exciting opportunities ahead!

If you enjoyed this article and are eager to read more, kindly consider liking and subscribing (it’s free) to my Substack. Additionally, if you notice any inaccuracies or have any suggestions, please share them in the comments section, and I will gladly make the necessary adjustments.

Feel free to connect with me on:

X: skeshav25

Ciao...