Revolutionizing DeFi: The Power of Meteora Dynamic Vaults

Exploring Innovative Strategies for Liquidity Optimization and Risk Mitigation in Solana's DeFi Sphere

The rise of Web3 and the crypto space has brought forth a plethora of innovative sectors, each vying for dominance. However, it is undeniable that Decentralized Finance (DeFi) has emerged as one of the most widely adopted and transformative areas within this realm. In its quest to revolutionize traditional financial systems, DeFi has successfully carved out a significant space for itself. One of the key contributors to this success has been the advent of liquidity pools, which have played a pivotal role in enhancing and surpassing the limitations of the traditional order-book system. By enabling seamless transactions, efficient price discovery, and increased liquidity, liquidity pools have propelled DeFi to new heights, offering users unprecedented opportunities and reshaping the future of finance.

Among these contenders, Solana has garnered attention for its unique features and potential impact on the DeFi landscape. With its high-speed transaction processing, low fees, and scalability, Solana presents itself as a promising platform that could revolutionize the way users engage with DeFi applications. Despite currently having a smaller user base compared to Ethereum, Solana's capabilities have the potential to improve the overall user experience within the DeFi ecosystem significantly.

In the expansive Solana ecosystem, one project that stands out is Meteora. Proclaimed as the Liquidity Backbone of Solana, Meteora has gained recognition for its crucial role in the ecosystem. In this article, we will explore why this claim holds, shedding light on its significance and impact on Solana's liquidity infrastructure.

Before delving into the specifics of Meteora, it's essential to grasp the fundamentals of liquidity and liquidity pools and their governance within various lending protocols.

1. Fundamentals of Liquidity and Liquidity Pools

Liquidity refers to how easily one asset can be converted into another asset. Likewise, Liquidity pools are collections of funds locked in a smart contract that follow generalized rules to regulate decentralized lending and trading.

As illustrated in Figure 1, liquidity providers have a crucial role in maintaining the balance within liquidity pools by providing a proportional allocation of tokens A and B based on their current market values. In return for their contribution, liquidity providers receive LP tokens, which represent their stake in the pool, as well as a portion of the transaction fees generated from each swap executed by users or traders. Additionally, within the broader context of decentralized finance (DeFi), this participation in liquidity provision is often associated with yield farming. Yield Farming involves leveraging one's crypto assets to generate additional returns by participating in various DeFi protocols, such as liquidity pools, lending platforms, or staking mechanisms, in pursuit of higher yields compared to traditional investment avenues.

At the core of liquidity pools lies the Automated Market Makers (AMMs), which play a pivotal role in ensuring the equilibrium within the pools through mathematical formulae. One such model is the Constant Product Market Maker, represented by the formula A * B = C (as illustrated in Figure 1). AMMs utilize these formulas to dynamically adjust the prices and quantities of assets within the pool, enabling efficient and automated trading without the need for traditional order books. By maintaining this balance, AMMs facilitate seamless transactions and contribute to the overall liquidity and stability of the liquidity pools.

1.1 What factors contribute to an eminent Liquidity Pool

Several essential characteristics significantly influence the performance of an outstanding Liquidity Pool:

Ample Liquidity: Having a substantial amount of assets locked in the pool ensures smooth trading and minimizes issues like slippage and impermanent loss.

Asset Diversity: Supporting a wide range of assets caters to different trading preferences, attracting a more extensive user base and promoting market depth.

Competitive Fees: Offering reasonable transaction fees encourages user participation and enhances the overall user experience.

Effective Price Discovery: Enabling accurate and real-time price determination ensures fair and efficient trading opportunities.

Robust Security and Transparency: Implementing strong security measures and providing transparent information instills trust and confidence among participants.

Active Community Engagement and Development: Cultivating a vibrant community and continuously improving the pool through development efforts fosters growth, innovation, and long-term sustainability.

In the following sections, we will explore how Meteora addresses these essential characteristics, enhancing the user experience through optimized yield, reduced lending protocol risks, and ensuring complete principal liquidity.

2. Meteora: Liquidity Backbone of Solana

Meteora, previously known as Mercurial, emerged as a decentralized exchange (DEX) operating within the Solana ecosystem, aiming to enhance liquidity. To achieve this goal, Meteora relies on several key products:

Meteora Dynamic Vaults

Dynamic AMM Pools

Multitoken Stable Pools

Non-Pegged Stable Pools

These products collectively contribute to improving liquidity within the Solana ecosystem. However, the emphasis of this article is on Meteora Dynamic Vaults and its role in providing better Annual Percentage Yields (APYs) while automating the yield farming process to mitigate risks.

3. Meteora Dynamic Vaults: Overview

Meteora Dynamic Vault, also known as Yield Layer of Solana, is the first DeFi’s Dynamic yield infrastructure where the Vault searches for the lending protocols with the best possible yields every minute and rebalances prioritizing the user funds to be accessible as much as possible.

Meteora Dynamic Vaults are designed to solve the challenges faced by users who are unable to consistently monitor their funds 24/7, whose funds are not optimized for yield, and who are unable to access their funds when they need them. The goal of Meteora Dynamic Vaults is to provide safe, sustainable yields for users and to help protocols grow their liquidity without relying on liquidity mining.

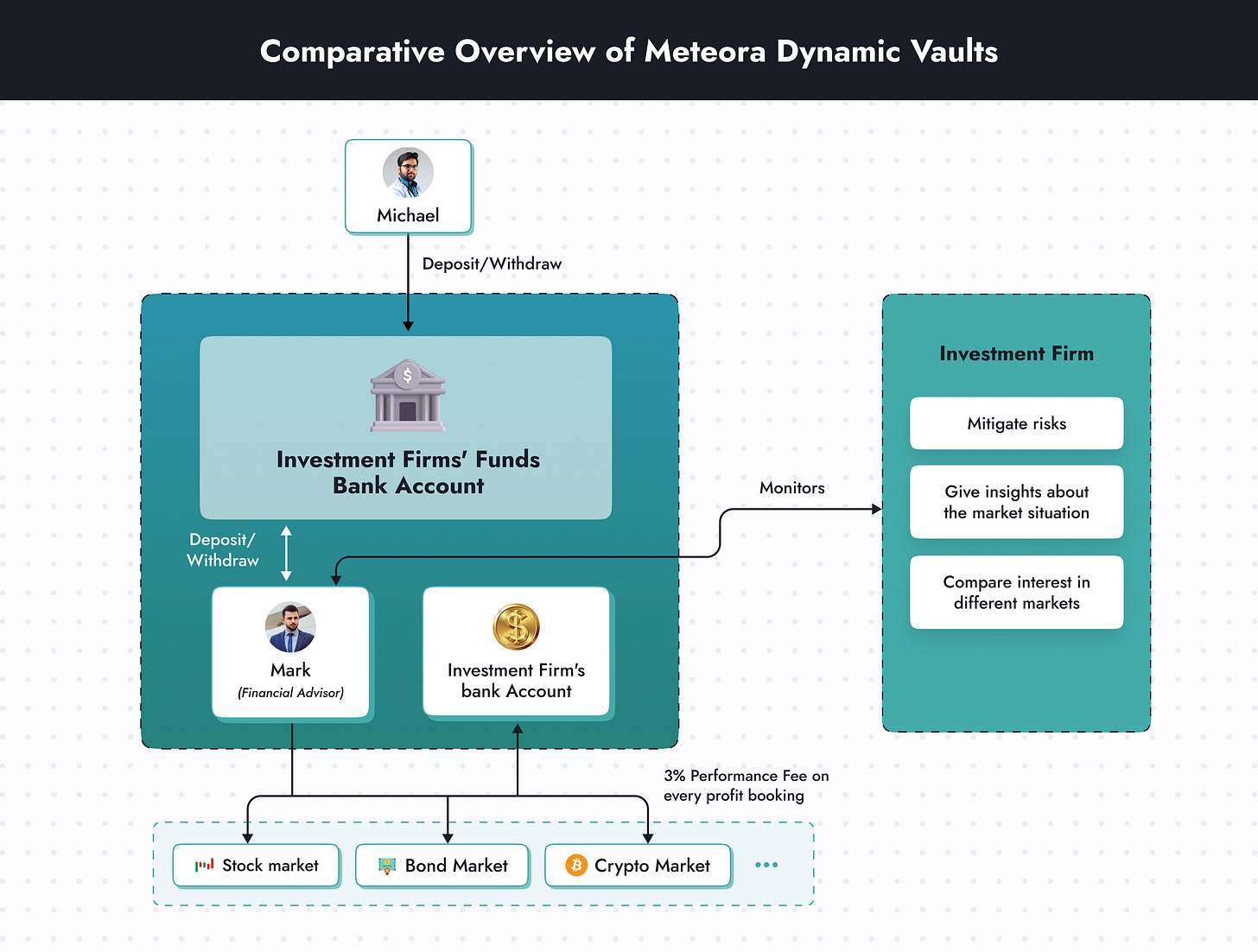

To gain a deeper grasp of the mechanism, it is beneficial to learn about the operations of an investment firm through a story.

3.1 Simplifying Dynamic Vaults (ELI-5)

Let us begin with a story to create a vivid depiction of Dynamic Vaults, connecting the dots in the upcoming segments.

Story:

Michael, a successful doctor, had an unexpected affinity for participating in lotteries, hoping to strike it luckily. In a delightful turn of events, fortune smiled upon him in the most recent draw, granting him a remarkable prize of $1,000,000. With his financial stability already established, he decided to allocate half of the amount to a secure bank account while seeking opportunities to invest the remaining portion.

Michael entrusted an esteemed investment firm with $500,000 to make informed investment decisions on his behalf. The firm assigned Mark, a dedicated financial advisor, to handle his investments and keep him updated on returns. Mark utilized his expertise to strategically invest across different markets, for example, stocks, bonds, cryptocurrencies, commodities, etc. Throughout the investment journey, Mark maintained regular communication with Michael, providing updates on progress and returns, while the investment firm would charge a 5% performance fee on the returns they booked.

Over time, Michael witnessed his investments flourish, with Mark's careful management and diligent market monitoring yielding positive results. The investments not only provided financial security but also expanded his wealth. Grateful for the guidance and transparency he received, Michael developed confidence in the investment firm and Mark's abilities as his trusted advisor.

As Michael's portfolio continued to grow, his trust in Mark and the investment firm deepened. Their collaborative efforts propelled his financial well-being and opened up new possibilities for the future. With Mark's expertise and ongoing updates, Michael felt empowered to explore further investment opportunities, knowing that his finances were being handled professionally.

The story ends….

This section provided a preliminary understanding of how Dynamic Vaults (Figure 2) will be similar to the architecture in Figure 3. In the following section, we will delve deeper into the connection between the concepts introduced in the story along with the illustration (Figure 3) and how they relate to Meteora Dynamic Vaults.

3.2 Key Concepts of the Dynamic Vault

It is now time to delve into all the technicalities the Dynamic Vault has to offer. The following terms are to be understood to get a vivid picture of how the Dynamic Vaults are governed:

Vault: where single token assets are stored (in individual vaults), i.e., individual tokens have individual vaults.

Hermes - Keeper Program: an off-chain keeper, to manage complex logic and operations to calculate optimal yielding opportunities and mitigate risks.

Operator: the authorized wallet address, with the sole purpose to distribute/withdraw funds into/from different protocols and no other place.

Strategy Handler: the interface that links the vault to the external lending platforms utilizing the operator.

Lending Platforms: helps individuals borrow and lend funds allowing the asset holders to earn a considerable income.

Rebalance Crank: happens when an operator deposits to or withdraws from a lending protocol (occurs every few minutes to maintain accessibility).

Treasury: where 5% of the performance fees go after every rebalance to support the organization.

Dapps/Protocols/Users: consumers who fund the vault with an incentive to produce yield.

It should be clear to us about all the comparative terms we used in our story concerning the terms above.

In this scenario, Michael can be referred to as a User, as he invested funds for potential returns.

The bank account held by the Investment Firm, which Mark used for trading, can be seen as The Vault, serving as a centralized location for managing the funds.

The Investment Firm can be compared to Hermes - Keeper Program, as they possess crucial metrics, insights, and risk information about different markets.

Mark, the financial advisor, can be related to Operator who operates Strategy Handler.

The different markets mentioned can be described as various Lending Protocols, representing the platforms or systems where the investments are to be made.

The Investment Firm's bank account can be associated with the Treasury where the 3% performance fees are deposited on every profit booking.

Every profit booking can be compared to Rebalance Crank. Unlike traditional investment firms, rebalancing occurs every few minutes.

This section likely provided significant clarity regarding the technical terms associated with Dynamic Vaults.

4. The Brain: Hermes - Keeper Program

Hermes, according to Greek mythology, is the messenger of gods. Likewise, within this context, Hermes acts as the intermediary, disseminating all off-chain insights to the on-chain vault smart contracts. Hermes executes intricate logic and operations, encompassing monitoring, calculations, optimizing yield, and mitigating risks across diverse lending platforms.

The 3 critical operations executed by Hermes are:

Yield Optimizer - executes calculations regarding the liquidity allocation across different lending platforms with optimal overall APY. Once allocated, the process repeats until there is a difference (delta) between the new allocation that is to be made and the current which is already allocated. If there is a significant delta (0.1%), rebalance crank will be sent to the vault and the performance fees is sent to the treasury.

Key Metrics Tracker - provides all the key metrics, i.e., Deposit APY, utilization rate, liquidity in a pool, etc. required to calculate optimal APY as discussed above. This data can also be accessed by the integrators (using Meteora’s SDK) to calculate and display on their UIs.

Risk Monitoring - monitors risks by tracking utilization rates and reserve levels of various lending protocols to safeguard the user funds, ready to send the message to the contract to withdraw whenever the threshold is achieved.

4.1 Yield Optimizer Algorithm

One of the three crucial operations executed by the Keeper, the yield optimizer algorithm, is responsible for all the decisions, whether, it is allocating funds to different lending platforms, rebalancing, or reallocating again.

Before, getting into the whole algorithm, it is wise to get familiar with our purpose, i.e. APY.

APY, or Annual Percentage Yield, is a measure of how much interest you can earn on your savings or investments over a year, taking into account the compounding effect. It's important to compare APYs when choosing where to put your money because a higher APY means you can earn more money in the long run.

Algorithm:

Blocks 1 and 2 divide the funds in the vault into smaller portions, referred to as deposit_amount, aiming to find optimal yields. The administrator sets this value, which must be equal to or greater than 100.

Block 3 initializes the necessary array variables required for subsequent calculations.

Starting from block 4, a while loop continues executing until i exceeds the designated portion.

Block 5 contains a for loop that simulates interactions with various lending platforms, storing the Annual Percentage Yield (APY) of each platform in the APY[] array, as seen in Block 7.

The highest APY among all platforms is stored in the variable highest_APY_platform as indicated in Block 8.

In Block 9, the allocation[highest_APY_platform] is updated with deposit_amount.

This process is repeated until all portions and platforms have been simulated.

Once all loops terminate, Block 11 calculates the difference (delta) between the intended allocation and the previous allocation. If the difference exceeds 0.1%, the execution proceeds to Block 11, where the rebalance process involving deposit and withdrawal takes place, commonly referred to as a rebalance crank.

4.2 Rebalance Crank Mechanism

We have come to an understanding of how the yield optimizer algorithm assists in figuring out the optimal yield among all the lending platforms available. Now is the time, to understand how profits are calculated as well as deposit and withdrawal process works, i.e. Rebalance Crank.

It’s important to familiarize yourself with a couple more jargon before calculating profits and the total amount.

Total amount in vault (T): the combined value of the remaining tokens in the token vault and the overall liquidity deposited across all strategies.

Liquidity in token vault reserves (A): the actual amount of tokens in the token vault reserves.

Current liquidity in a strategy (C): Total amount of liquidity deposit in a strategy.

The above illustration (figure 5), does enough justice to explain the calculation of the profits and total amount after rebalance.

The 5% of the performance fee is deducted from the difference between T2 and T1, i.e.

The strength of Dynamic Vaults lies in its Rebalance Crank mechanism, which ensures a robust level of security for user and protocol funds. Even in the event of operator compromise, the execution of deposits and withdrawals is limited to the vault and designated lending protocols. This prevents hackers from transferring funds to unauthorized wallets, as the operator lacks the authority to do so.

4.3 Risk Factors & Mitigation

Before initiating fund rebalancing, it is crucial to assess and quantify potential risks. If risks are identified, Hermes takes proactive measures to mitigate and address them effectively.

There are two kinds of risks when it comes to Hermes:

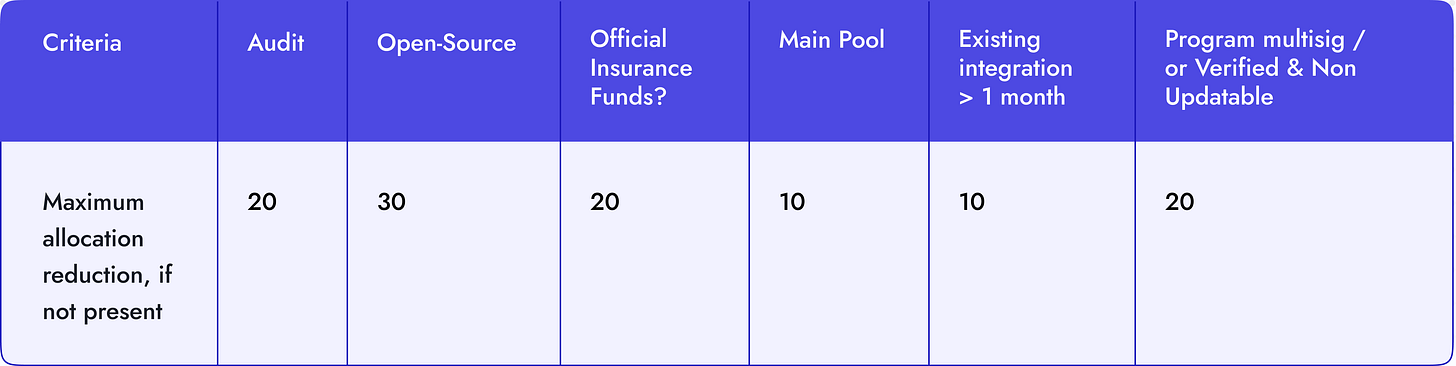

Operational risk: As mentioned earlier, one of the key strengths of Dynamic Vaults is its ability to rebalance periodically, granting it the advantage of assessing market risks and responding accordingly. Even in the event of a successful attack on Hermes, the hacker's actions are limited to transferring funds between the vault and lending protocols, preventing them from accessing or removing the principal amount. Additionally, there are maximum allocation criteria for each lending protocol, ensuring that rebalancing is capped at a threshold based on the protocol's status given below.

Lending risk: This risk arises when the utilization rate reaches 100%, indicating that the borrowed amount matches the deposited amount, or when the reserves in the lending pools fall below the vault deposits. To safeguard principals and mitigate lending risks, mechanisms have been developed, including diversifying allocations across multiple lending options for effective risk management. Hermes closely monitors utilization rates, promptly withdrawing funds when the threshold of 80% is exceeded.

This designation of Hermes as the "Keeper Program" resonates with its pivotal role as the brains behind Dynamic Vaults, guiding risk mitigation and ensuring the overall system's stability. Its ability to monitor and respond to changing conditions further solidifies its significance in securing and managing user funds.

5. How did Dynamic Vault address Sandwich Attack?

A Sandwich Attack in decentralized finance (DeFi), particularly in liquidity pools, is a sophisticated and unethical manipulation strategy employed by malicious actors to exploit vulnerabilities in the trading process. In this attack, the attacker takes advantage of the time delay in executing transactions on the blockchain.

It’s a 4-step process to exploit the victim:

Detection: The attacker identifies the transaction being initiated by the victim in the target liquidity pool.

Front-Running: The attacker swiftly executes their transaction ahead of the victim's transaction, taking advantage of the time delay in blockchain confirmation.

Increased Slippage: As a result of the front-running, the victim's transaction experiences higher slippage, leading to unfavorable prices or reduced profits.

Back-Running: To further exploit the situation, the attacker executes additional transactions that benefit from the price movement caused by the victim's transaction, maximizing their gains at the expense of the victim.

Sandwich attacks are unjust to honest users and protocols who have deposited their assets to gain yield. To overcome this, instead of distributing 100% of the yield after rebalancing, the system will drip the yield in a pre-determined period. All profits earned from strategies are locked by default and are unlocked with a specified percentage per second.

Even if the potential attacker tries to gain an advantage out of this, they will get only a tiny fraction of the original yield, which makes it unattractive.

6. What makes Dynamic Vaults look so attractive?

Dynamic Vaults within the Solana ecosystem offer several key elements that have the potential to revolutionize the DeFi ecosystem. These include:

Implementation of a comprehensive risk management framework that prioritizes maximizing yield, mitigating risks associated with lending protocols, and ensuring the presence of full principal liquidity.

Assurance of the safety of principals at all times, instilling confidence in users' investments.

The keeper program, responsible for optimizing yield allocations, strictly restricts fund flows from vaults to protocols, preventing access to funds or the claiming of principals.

Users have the freedom to withdraw funds according to their preference, highlighting the importance of liquidity and empowering users.

Meteora provides a software development kit (SDK) in Rust and Typescript, simplifying the integration of functionalities into protocols for enhanced user convenience.

The proven effectiveness of Meteora is demonstrated through the case studies mentioned in their whitepaper, further strengthening their ability to mitigate risks in challenging situations.

Collectively, these features and qualities make Meteora Dynamic Vaults a powerful solution that significantly improves the user experience, particularly for newcomers to the DeFi ecosystem. It represents a significant step towards achieving a better, more user-friendly DeFi experience.

7. Conclusion

Through this article, we have explored the remarkable potential and features of Meteora Dynamic Vaults within the Solana ecosystem. From its comprehensive risk management framework to its emphasis on principal safety and user flexibility, Meteora has the power to revolutionize the DeFi ecosystem.

As we conclude this journey, we look forward to the positive impact that Meteora Dynamic Vaults can bring to the DeFi ecosystem. With its focus on innovation, security, and user-centric design, Meteora sets a strong foundation for a future where individuals can confidently participate in decentralized finance, making the most of their investments while enjoying a seamless and rewarding experience.

Embracing the potential of Meteora and its dynamic approach to liquidity management, we anticipate a brighter future for the DeFi ecosystem, empowering users and paving the way for widespread adoption.

If you enjoyed this article and are eager to read more of its kind, kindly consider liking and subscribing to my Substack. Additionally, if you notice any inaccuracies or have any suggestions, please share them in the comments section, and I will gladly make the necessary adjustments.

Feel free to connect with me on:

Discord username: keshav08

Twitter handle: skeshav25

Ciao…